Have feedback on this article? Concerned about the content? Get in touch with us directly. We currently account for open market transactions and private dispositions, but not derivative transactions.

So you may wish to see this free collection of high quality companies.įor the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. Of course NVIDIA may not be the best stock to buy. Luckily, you can check this free report showing analyst forecasts for its future. If you are like me, you may want to think about whether this company will grow or shrink. While we feel good about high insider ownership of NVIDIA, we can't say the same about the selling of shares. There haven't been any insider transactions in the last three months - that doesn't mean much. So What Do The NVIDIA Insider Transactions Indicate? Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders. It's great to see that NVIDIA insiders own 4.0% of the company, worth about US$12b.

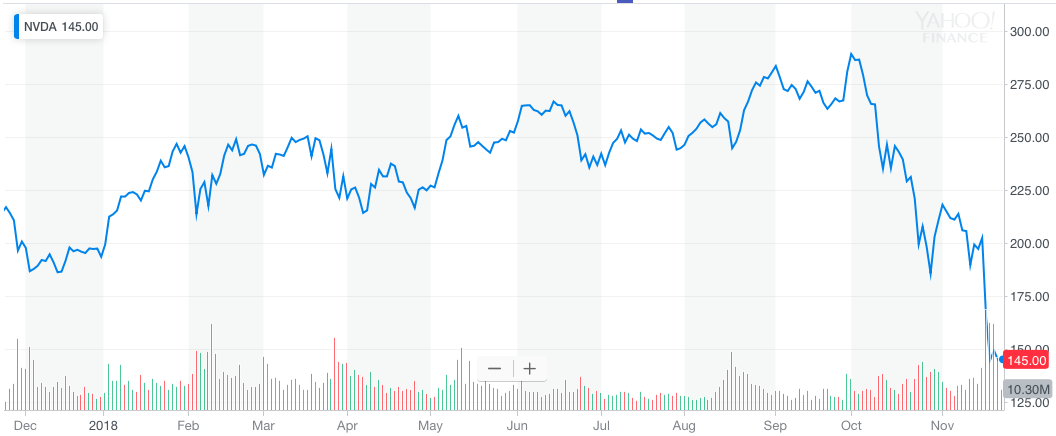

We usually like to see fairly high levels of insider ownership. I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. So it may not tell us anything about how insiders feel about the current share price.įor those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket. The silver lining is that this sell-down took place above the latest price (US$121). While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. In the last twelve months, the biggest single sale by an insider was when the Independent Director, Mark Stevens, sold US$51m worth of shares at a price of US$186 per share. See our latest analysis for NVIDIA The Last 12 Months Of Insider Transactions At NVIDIA While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether. The company’s market cap plunged by US$9.4b after price dropped by 3.0% last week but insiders were able to limit their loss to an extent. Insiders seem to have made the most of their holdings by selling US$156m worth of NVIDIA Corporation ( NASDAQ:NVDA) stock at an average sell price of US$212 during the past year.

0 kommentar(er)

0 kommentar(er)